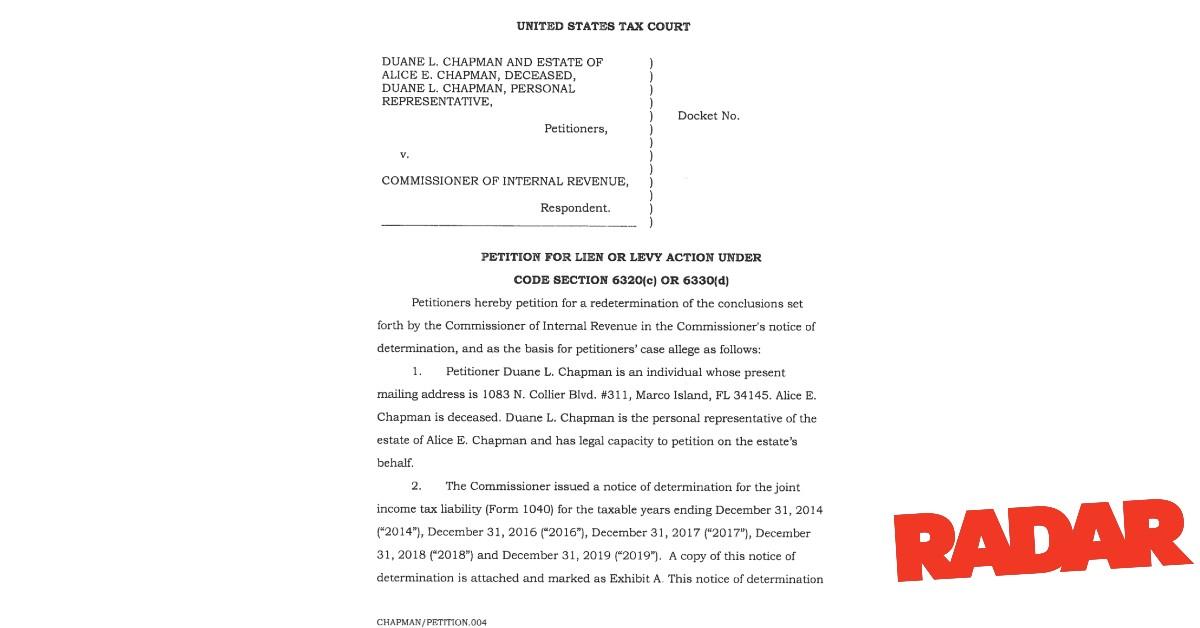

Exposed: Dog The Bounty Hunter's Fight With IRS Over $1.6 Million Owed in Unpaid Taxes

Oct. 26 2023, Published 6:00 p.m. ET

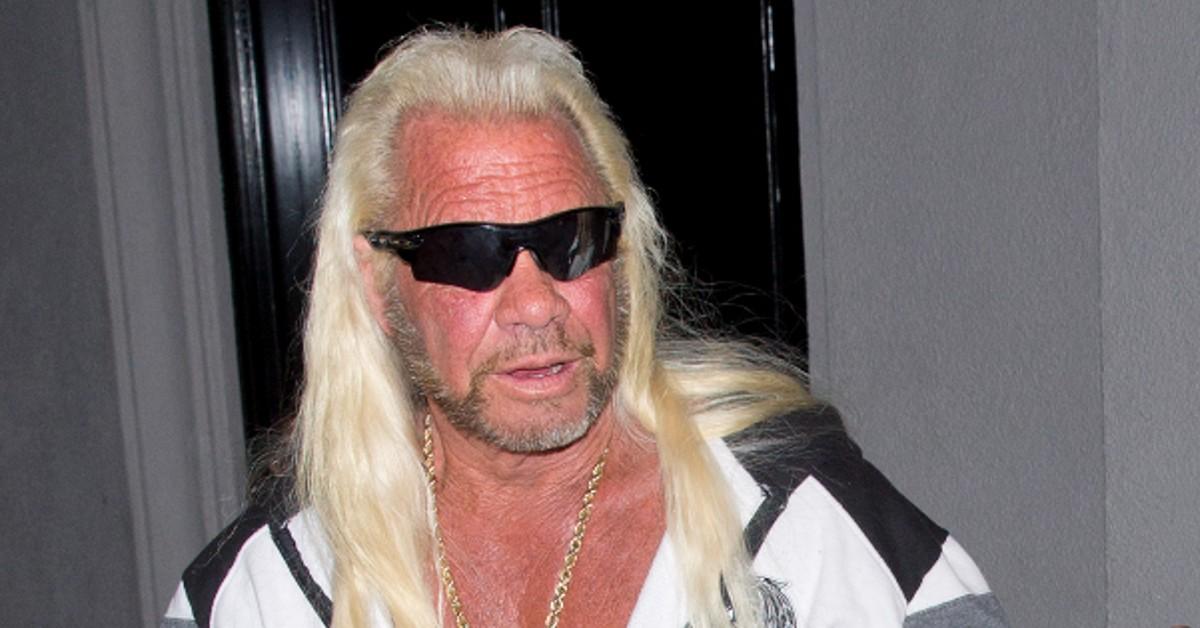

Dog the Bounty Hunter earned millions tracking down hard-to-find criminals, but now RadarOnline.com has exclusively unearthed the reason why the reality star is being dogged by the Internal Revenue Service for unpaid taxes.

The long-simmering dispute erupted when Dog claimed the IRS didn’t properly serve him with delinquent tax notice in 2012 – which has now ballooned to about $1.6 million, according to published reports.

The feds accused the reality star of being harder to find than a fugitive because the supposed home address on his tax returns changed THREE times between 2010 and 2011, according to documents obtained by RadarOnline.com.

Dog The Bounty Hunter has been dogged by the IRS for years.

In fact, in a 2019 ruling, United States Tax Court Judge Tamara Ashford slammed the now 70-year-old muscle-bound hunk for being cagey about his home address.

The documents showed Dog listed his home address as the Los Angeles offices of the two separate accountants who filed his tax returns — instead of his home in Hawaii. And even in Hawaii, he listed two different addresses, one on Queen Emma Street and the other on Portlock Road.

“At no time during the period between the IRS' processing of the 2010 return and the mailing of the deficiency notices (tax bill) did either petitioners (Dog) or anyone on their behalf notify the IRS orally or in writing that petitioners wished the IRS to use the Queen Emma Street address or the Portlock Road address to communicate with them,” the judge stated in tossing out his attempt to avoid paying Uncle Sam.

Dog recently filed a petition trying to avoid tax bills from 2014 to 2019.

The judge also determined Dog could not claim he wasn’t properly served with a delinquent notice — and his shifty address scheme is no excuse.

The judge explained Dog’s rationale would “impose an unreasonable administrative burden on the IRS ... so that it could be sure it was sending the taxpayer a notice of deficiency (tax bill) to every conceivable "known" address of that taxpayer.”

Records show Dog, who has an estimated worth of $6 million, has been slapped with an eye-popping 17 federal tax liens since 1990 – the largest being $1.8 million in 2009 in Hawaii. The most recent tax lien for $800k was filed in Colorado in 2022.

The reality star was chided by a U.S. Tax Court judge for using unusual home addresses in his tax returns.

The TV tough guy, who now lives in Florida, recently filed a petition disputing the tax bills for 2014, 2016, 2017, 2018 and 2019 accusing the Tax Commissioner of various infractions including:

“The Collection Division did not send a prior notice of lien filing or notice of intent to levy for these liabilities to petitioners or their authorized representatives.”

Visit the all-new RADAR SPORTS for all the on and off-field activities of the biggest names in the games.

Not surprisingly the Florida mailing address Dog provided the IRS is a UPS Store in a shopping strip anchored by a Publix Supermarket.

Sadly, the IRS tax bill also names beloved reality star Beth Chapman, who died from stage 2 throat cancer in 2019 and is labeled as a co-defendant because her fugitive chasing husband is the executor of her estate.

In his latest petition he lists his mailing address as a UPS store in Florida.

Powered by RedCircle