‘Being Mary Jane’ Star Lisa Vidal Sues Ex-Business Manager for $2 Million One Year After Son’s Tragic Death

Sept. 11 2023, Published 5:30 a.m. ET

Actress Lisa Vidal is accusing her ex-business manager of causing her emotional distress after causing havoc to her finances, RadarOnline.com has learned.

According to court documents obtained by RadarOnline.com, the actress and her husband Jay Cohen are suing DLD Accountancy LLP, Dennis Duban, David Wilcox, and Steve Wojnarowski.

The suit accuses the defendants of breach of contract, negligence, negligent infliction of emotional distress and misrepresentation.

Vidal said she entered into a contract with DLD and Duban in 2013, where they would act as her business manager and CPA tax advisor.

The actress said DLD and Duban were to manager her and her entertainment company’s finances including taking care of tax filings and paying bills.

However, Vidal said the company failed to pay bills or paid bills to incorrect parties. She accuses them of failing to perform the tasks for which they were hired.

“They also routinely wrote checks and made payments with inaccurate sums to the wrong entities,” the suit read. As a result, Vidal said she was hit with a $15k tax liens by the IRS and California Franchise Tax Board in 2015. However, she said she was never informed of the debt by her business manager.

In 2017, she claimed DLD and Duban failed to file her taxes. She said the IRS then filed a $400k lien against her which DLD never informed her about.

“The IRS and the FTB sent numerous mailings to DEFENDANTS regarding the tax assessment, none of which were disclosed to PLAINTIFFS. Eventually, the IRS created a tax lien in the approximate amount of $400,000.00. PLAINTIFFS were unaware of the tax lien,” the suit read.

Vidal said the DLD and Duban failed to file her taxes for 2019 and 2020. She said DLD demanded she pay an additional $16k to file her past due taxes, “despite being contractually obligated to file them.”

In 2020, Vidal said she sold her home only to find out the IRS had placed liens totaling $400k on the property.

“Shortly after the sale of their home, the IRS seized approximately $400,000.00 from VIDAL for tax liens resulting from the acts and omissions of DEFENDANTS,” the suit read.

In addition, Vidal said she learned that the defendants had been “requesting and transferring money” from her 401k to her checking account.

Vidal is demanding in excess of $2 million in damages.

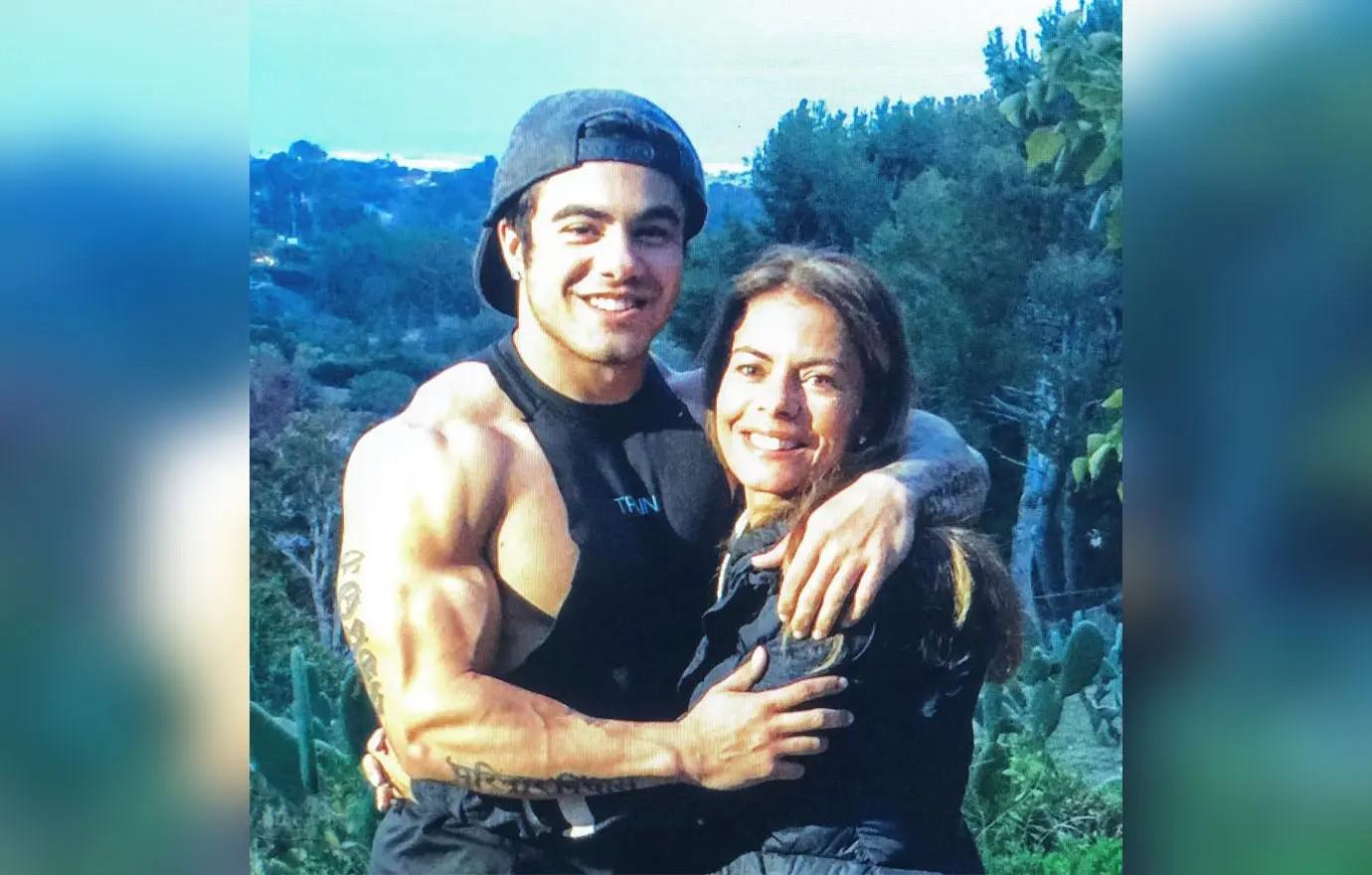

The lawsuit comes months after Vidal lost her son Scott Cohen after he committed suicide at the age of 28.